A Personalized Home Buying Experience

I understand that buying a home is one of life’s most significant decisions and a deeply personal investment. That’s why I am committed to providing exceptional service, ensuring every step of your real estate journey exceeds expectations.

When you work with me, you’ll experience a truly elevated buying process. With years of expertise and in-depth knowledge of the Puget Sound market, I go above and beyond to find the perfect home for you. From expert guidance to full-service buyer representation, I handle every detail with care and precision, making your home-buying journey seamless and stress-free.

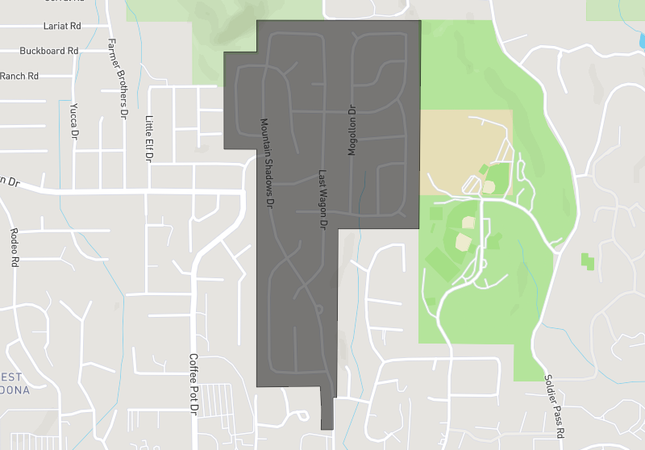

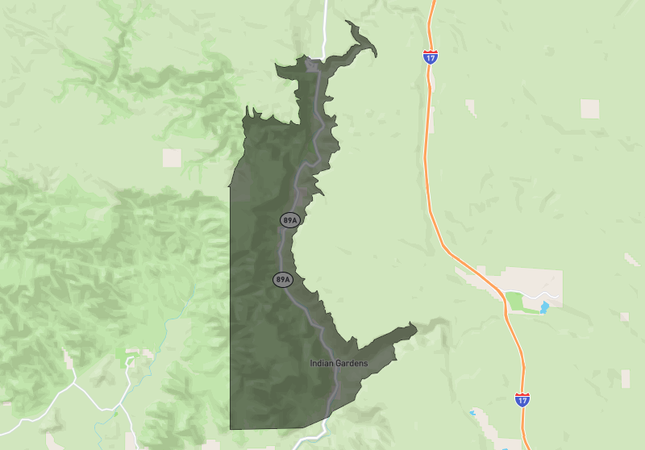

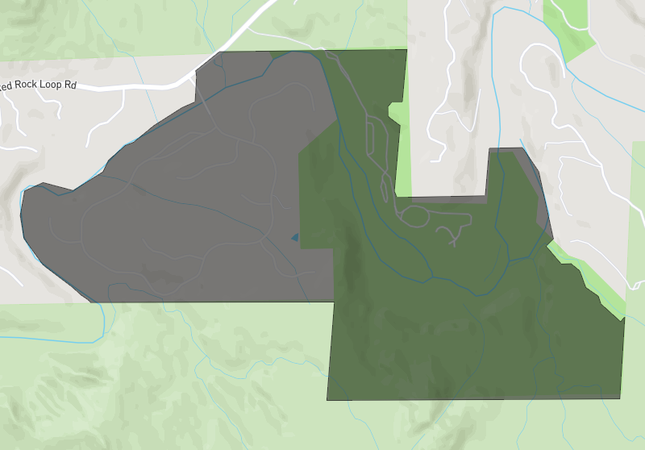

As one of the top 1% of real estate professionals nationwide, verified by RealTrends, Nisreen brings unmatched expertise to your home search. With 26 years in Sedona and the Verde Valley, she knows every neighborhood, market trend, and hidden gem, ensuring you find the perfect home. Her mastery of social media and off-market strategies gives you a competitive edge, uncovering listings before they even go public. With a proven track record in securing homes in competitive markets, she will guide you through Arizona’s real estate landscape with ease and confidence.

Over

Over

Handpicked Listings

Here for Every Step of

Your Home Journey

I am here to provide you with personalized service and help you achieve your home-buying goals. I take the time to get to know you and your needs so that I can find the perfect home for you.

Meet with me to review your budget, discuss your goals, and understand the buying process, so you're ready to begin your search.

Consultation

I will connect you with a trusted local lender to confirm your budget. A pre-approval strengthens your offer and sets clear expectations.

Get Pre-Approved

Receive tailored listings based on your needs. Share your favorites, and I will happily schedule showings to explore your top picks.

Start the search

When you find the perfect home, I will submit your offer and guide you through every step of the process, including negotiations if needed.

Make an Offer

I will represent you during negotiations, working to secure the best possible price and terms for your dream home.

Negotiations

Celebrate becoming a homeowner! I will guide you through closing and ensure everything is in place for your big move.

Closing

Exclusive Access to Off-Market Homes

My clients enjoy early access to off-market properties, giving them a competitive edge in finding their perfect home. With my connections and insider knowledge, I open doors to homes not yet available to the public, ensuring you have the best opportunities before they hit the market.

Hear What Our Clients Have to Say

Find it all,

closer to home

Explore the eclectic lifestyles that the Puget Sound region has to offer, from waterfront living to vibrant urban neighborhoods, charming small towns to peaceful retreats. Discover the diverse areas below and find the one that matches your perfect lifestyle.

how to qualify for an arizona home loan

I understand that buying a home is one of life’s most significant decisions and a deeply personal investment. That’s why I am committed to providing exceptional service, ensuring every step of your real estate journey exceeds expectations.

When you work with me, you’ll experience a truly elevated buying process. With years of expertise and in-depth knowledge of the Puget Sound market, I go above and beyond to find the perfect home for you. From expert guidance to full-service buyer representation, I handle every detail with care and precision, making your home-buying journey seamless and stress-free.

Qualifying for Arizona mortgage loans is an important step in buying a home. Understanding the process can help ensure that you are able to qualify for the home loan that you need.

Lenders look at two things when determining if you are able to qualify for a home loan: your ability to repay the loan and your willingness to repay it.

Ability to repay

The first thing that a lender wants to know is if you are able to repay the loan for which you are applying. The lender looks at your current employment. Have you been in the same job for at least two years or at least the same line of work for a few years? This shows the lender that you have steady employment, and its a great plus in qualifying for a home loan.

The lender also looks at your total income and compares it to your debts, adding in your proposed monthly mortgage payment. You must have sufficient income to comfortably make these payments. This reflects your ability to repay the loan when qualifying for a home loan. If the lender believes your debt load is too high, you will qualify for a smaller loan and likely be charged a higher interest rate. Therefore, it makes sense to pay off as much debt as possible before applying for a home loan.

Willingness to repay

The next step in qualifying for a home loan is determining your willingness to repay the loan. Lenders determine this by looking at how you have paid off debt in the past, and it is one reason why lenders check your credit report. If you have faithfully made on-time payments toward your past debts, it helps you when qualifying for a home loan. The lender also looks at how you intend to use the property that you are buying. If you plan to live there, it is more likely that you will repay the loan.

The lender may ask you for a very complete financial picture of your life, your income, assets, credit report, etc when qualifying for a home loan. Once you provide all of this information and the lender is able to verify it, this shows the lender your ability and willingness to repay the loan, The lender is then able to help you qualify for Arizona mortgage loans.

Discover What Sets Me Apart

I would love to connect with you and answer any questions you have about Sedona and the Verde Valley. Let's discuss the current market and how I can help you achieve your property goals.

Call me anytime 928-399-9140.